What are mortgage points?

Mortgage points are fees you pay a lender to reduce the interest rate on a mortgage. Paying for discount points is often called buying down the rate and is totally optional for the borrower.

As you search for the lender with the best offer, be careful when looking at mortgage rates advertised online. When you read the fine print, you may find that one, two — or even three or more — discount points have been factored into the rates.

Discount points are totally optional. You’ll want to find out what a lender’s rate is without adding a bunch of upfront fees.

How many mortgage points shall I buy?

When you buy one discount point, you’ll pay a fee of 1% of the mortgage amount. As a result, the lender typically cuts the interest rate by 0.25%.

But one point can reduce the rate more or less than that. There’s no set amount for how much a discount point will reduce the rate. The effect of a discount point varies by the lender, type of loan and prevailing rates, as mortgage rates fluctuate daily — so it makes sense to shop around.

Buying points doesn’t always mean paying exactly 1% of the loan amount. For example, you might be able to pay half a point, or 0.5% of the loan amount. That typically would reduce the interest rate by 0.125%. Or you might be given the option of paying one-and-a-half points or two points to cut the interest rate more.

house_value <- 125 * 1e4

down_payment_percent <- 0.2

mortgage_rate <- 4.5/100

mortage_year <- 15

saving_rate <- 0.03Option 1: no points

a1 <- repayment(house_value * (1 - down_payment_percent),

beta = mortgage_rate / 12,

m = mortage_year * 12)

a1 * (1 - 1/(1 + saving_rate/12)^(mortage_year * 12)) / (1 - 1/(1 + saving_rate/12))## [1] 1110521Option 2: with points

# number of points

x <- 4Denote the down payment percentage with points is \(y\), considing the points fee can be part of the down payment. To equal the down payment with/without points, we have \[ \text{house value} \times (1-y) \times 0.01 \times x + \text{house value} \times y = \text{house value} \times \text{down payment percent}. \] So the value of \(y\) is

y <- (0.01*x - down_payment_percent) / (0.01 * x - 1)

print(paste0("The downpayment with points (considing the points fee can be part of the down payment) is ", y %>% round(4)))## [1] "The downpayment with points (considing the points fee can be part of the down payment) is 0.1667"

a2_a <- house_value * (1 - y) * 0.01 * x

a2_b <- repayment(house_value * (1 - y),

beta = (mortgage_rate - 0.25/100 * x) / 12,

m = mortage_year * 12)

a2_b <- a2_b * (1 - 1/(1 + saving_rate/12)^(mortage_year * 12)) / (1 - 1/(1 + saving_rate/12))

a2_a + a2_b## [1] 1122684A more generalized form

foo <- function(x){

# no points

a1 <- repayment(house_value * (1 - down_payment_percent),

beta = mortgage_rate / 12,

m = mortage_year * 12)

ans1 <- a1 * (1 - 1/(1 + saving_rate/12)^(mortage_year * 12)) / (1 - 1/(1 + saving_rate/12))

# points

y <- (0.01*x - down_payment_percent) / (0.01 * x - 1)

a2_a <- house_value * (1 - y) * 0.01 * x

a2_b <- repayment(house_value * (1 - y),

beta = (mortgage_rate - 0.25/100 * x) / 12,

m = mortage_year * 12)

a2_b <- a2_b * (1 - 1/(1 + saving_rate/12)^(mortage_year * 12)) / (1 - 1/(1 + saving_rate/12))

ans2 <- a2_a + a2_b

return(ans1 - ans2)

}

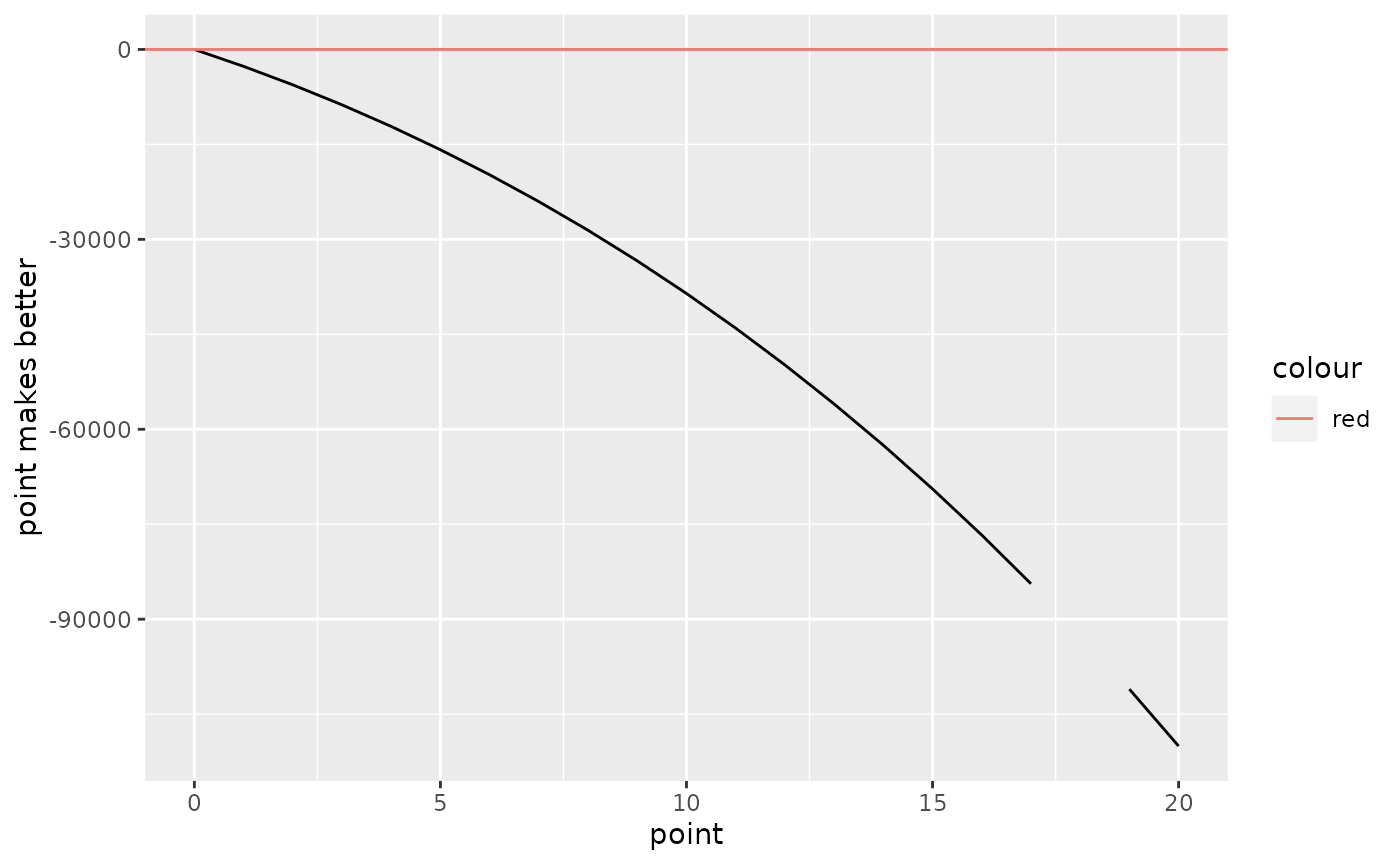

point_pool <- 0:20

tbl <- tibble(point = point_pool,

`point makes better` = lapply(point_pool, foo) %>% unlist())

ggplot() +

geom_line(aes(x = point, y = `point makes better`), data = tbl) +

geom_hline(aes(yintercept = 0, color = "red"))

## [1] -0.0001678966

y$f.root## [1] 0.2272884